Portfolio Strategy

The “Portfolio Strategy” section on The Modest Investor offers insights into various investment strategies, focusing on long-term portfolio management. It discusses the performance of the S&P 500, the benefits of the 60/40 portfolio, Ray Dalio’s All Weather Portfolio, and recommendations for ETFs to consider in 2024. The content is aimed at helping investors develop resilient and diversified portfolios that can withstand different market conditions.

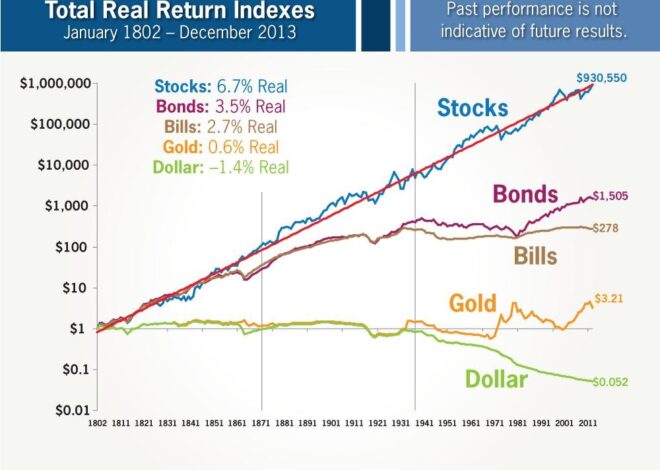

The incredible performance of S&P 500 index (and how to adopt it as an investment strategy)

The S&P 500, or the Standard & Poor’s 500 Index, serves as a prominent yardstick for measuring the performance of the American stock market. It encompasses 500 prominent publicly traded companies, showcasing a broad spectrum of industries and economic sectors within the United States. S&P 500 historical price by Google Finance The selection process for […]

The 60/40 portfolio: one of the most popular investment strategies

Small investors experience a rough fight when trying to beat the markets. In fact, according to JP Morgan, individual investors underperform the market as show in their graph below: Hedge funds, wall street, quantitative businesses and powerful people often feed from retail investor’s errors. This is why a passive approach could be the ideal path […]

Safety first: dissecting Ray Dalio’s All Weather Portfolio

Bridgewater Associates is the world biggest hedge fund in the world by assets under management (AUM). Ray Dalio, its funder, is a very influential investor, writer of the bestseller ‘’Principles’’, which I highly recommend. Bridgewater Associates was funded in 1975, and has delivered consistent returns over the years through macro strategy (uses economic analysis, shifts […]

Which are the best ETFs to invest in 2024?

As we said in this article about ETFs, this investment vehicle carries tons of benefits for investors, specially when we are in search for long-term passive investments. There are many types of ETFs in the market, and many companies that distribute them. Of course, it’s hard to look for astonishing returns (at least in the […]