On the reasons to learn how to invest

An overview exploring why everyone should be investing and how to do it efficiently. According to JP Morgan, the retail investor makes, on average, a 3.6% of annual return over their portfolio, while the classic 60/40 portfolio (60% invested in stocks and 40% in bonds) returns 7.4%. If you don’t want to be an average […]

Bitcoin ETF: the approval could signify the end of crypto winter

The inevitable arrival of institutions in the cryptocurrency space is coming through a Bitcoin ETF. They manage over $15 trillion and demand the ability to offer Bitcoin to their clients worldwide. Key Takeaways: The SEC’s demands on Binance and Coinbase coincide, perhaps intentionally, with the submission of several Bitcoin ETF proposals by major investment management […]

The incredible performance of S&P 500 index (and how to adopt it as an investment strategy)

The S&P 500, or the Standard & Poor’s 500 Index, serves as a prominent yardstick for measuring the performance of the American stock market. It encompasses 500 prominent publicly traded companies, showcasing a broad spectrum of industries and economic sectors within the United States. S&P 500 historical price by Google Finance The selection process for […]

The 60/40 portfolio: one of the most popular investment strategies

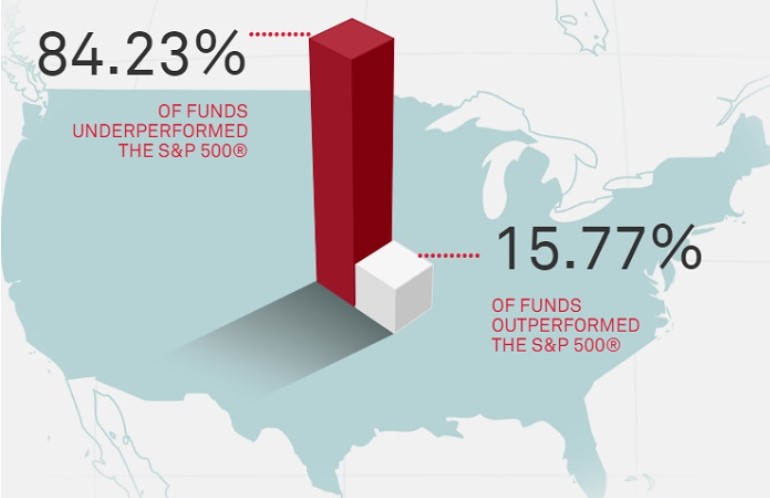

Small investors experience a rough fight when trying to beat the markets. In fact, according to JP Morgan, individual investors underperform the market as show in their graph below: Hedge funds, wall street, quantitative businesses and powerful people often feed from retail investor’s errors. This is why a passive approach could be the ideal path […]

Safety first: dissecting Ray Dalio’s All Weather Portfolio

Bridgewater Associates is the world biggest hedge fund in the world by assets under management (AUM). Ray Dalio, its funder, is a very influential investor, writer of the bestseller ‘’Principles’’, which I highly recommend. Bridgewater Associates was funded in 1975, and has delivered consistent returns over the years through macro strategy (uses economic analysis, shifts […]

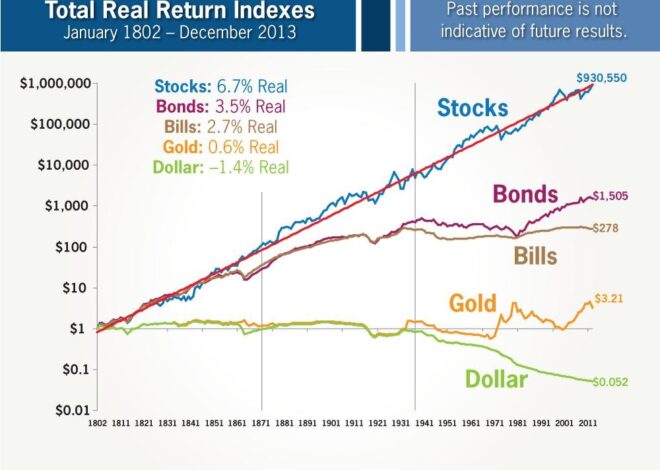

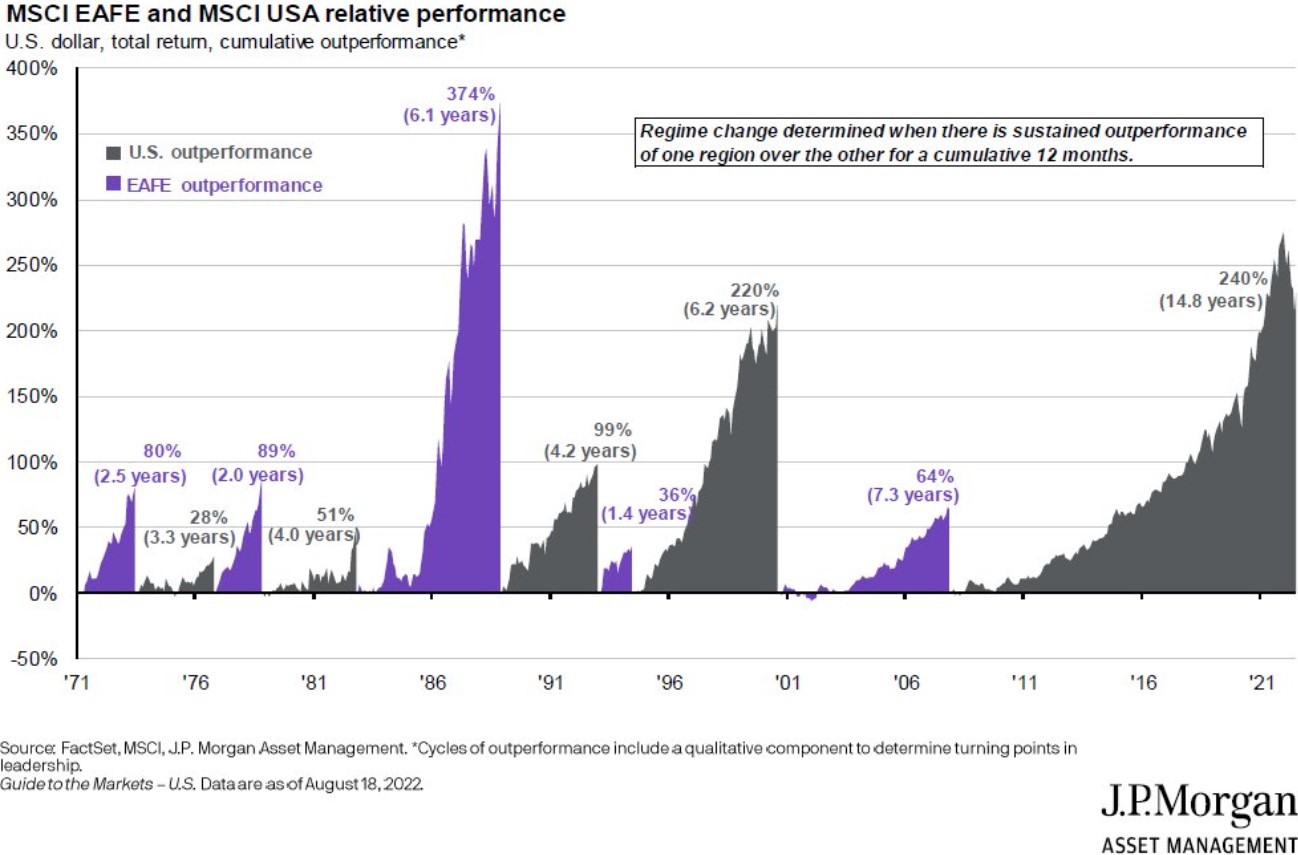

US assets: Why are they the biggest holding of funds and indexes across the world?

There are reasons why the vast majority of the money invested in the stock markets goes to US assets. If you study the world’s main funds, it’s not surprising to see US holdings as the biggest portion of the fund’s portfolio. Even worldwide funds, like Vanguard Total World Stock Index Fund (VTWAX) which manages almost […]

Which are the best ETFs to invest in 2024?

As we said in this article about ETFs, this investment vehicle carries tons of benefits for investors, specially when we are in search for long-term passive investments. There are many types of ETFs in the market, and many companies that distribute them. Of course, it’s hard to look for astonishing returns (at least in the […]

ETF (Exchange Traded Funds): The best option for retail investors?

ETF (Exchange-Traded Funds) are financial instruments listed on the stock market that represent one of the best options for small investors who seek long-term investments, due to their low fees of management and significant diversification benefits, as well as excellent historical returns. What is an ETF? An ETF is a financial asset that seeks to […]

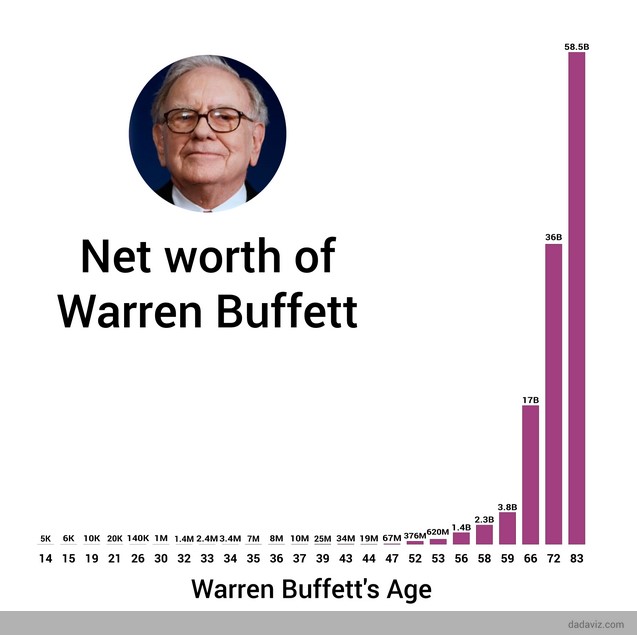

How to Become a Millionaire?

You’ve probably asked yourself this question many times throughout your life, and undoubtedly most of the answers you’ve heard or read about it are almost like fantasy events that defy the norm. The reality is that if you want to know how to become a millionaire, bear in mind that this is possible for anyone […]

Analyzing the Cryptocurrency Market in 2024 – an Interview

A few days ago, a college student interviewed me for a project on the cryptocurrency market. The task turned out to be interesting as it forced me to analyze some personal perspectives on the current state of the market. Additionally, I believe it can help curious individuals discover the benefits and disadvantages of this financial […]