Safety first: dissecting Ray Dalio’s All Weather Portfolio

Bridgewater Associates is the world biggest hedge fund in the world by assets under management (AUM). Ray Dalio, its funder, is a very influential investor, writer of the bestseller ‘’Principles’’, which I highly recommend. Bridgewater Associates was funded in 1975, and has delivered consistent returns over the years through macro strategy (uses economic analysis, shifts in inflation and monetary policy trends and many other parameters to predict the markets). Bridgewater’s most famous fund is named the All Weather Portfolio.

KEY TAKEAWAYS

- Bridgewater has several strategies: Pure Alpha, Pure Alpha Major Markets, All Weather and Optimal Portfolio.

- All Weather Portfolio is characterized by its low volatility

- Retail investors can´t invest in the fund (yet we can replicate it 😉)

- The All Weather Portfolio fund is intended to deliver safe returns with low risk

- The idea behind the creation of the All Weather Portfolio was to find an allocation that works no matter what the future holds

Hedge funds from all over the world manage approximately 4.5 trillion dollars, and nowadays there are about 15.000 operating entities. These businesses actively manage client’s funds through investments in the stock market.

There’s a difference between hedge funds and asset management firms like Blackrock and Vanguard, which manage about 9 and 7 trillion US dollars. These companies offer investment products like ETF’s or funds, instruments in which hedge funds invest in. Actually, the two biggest holdings of one of Bridgewater’s biggest funds are two Blackrock ETF’s (S&P 500 and an emerging markets ETF).

Bridgewater Associates manages in 2023 more than U$S 200 billion. Here´s a picture provided by The Visual Capitalist, depicting the world´s biggest hedge funds (it´s a little bit outdated, but the principal funds are clearly displayed):

In an increasingly unpredictable world, with history demonstrating recurring black swans that could destroy massive amounts of money, a low risk, safe investment strategy could be a good option for investors who can´t deal with high volatility. The All Weather Portfolio is a fund with the objective of delivering returns in any macroeconomic scenario, with low drawdown and high diversification.

How can I invest in Bridgewater Associates?

Well, as a retail or small investor, you can´t. Bridgewater´s clients are mainly pension funds or government entities, essentially, institutional investors. If you are an accredited investor and manage something like U$S 7.5 billion, maybe you can be admitted. Besides, like in any hedge fund, you should pay high fees.

The classic cost structure of hedge funds is a 2% fee over the total portfolio value, adding up, hedge funds charge 20% of the profits. These fees are paid annually. This is why I personally recommend investing in low-cost ETF´s, as the fees pile up in the long run impeding the full benefits of compounding.

Fun fact. Employees at Bridgewater Associates can invest in the funds without paying fees, so maybe there´s a good option…

What to learn from Ray Dalio and how to apply his investment strategy?

As we cannot invest in any of Bridgewater´s funds, what can we learn from them? Well, we could easily replicate the All Weather Portfolio by buying accessible assets like ETF´s and rebalancing periodically to maintain the proper allocation (we’ll get to this further in this article).

We are often invaded by this vision that ensures the stock markets only go up, specially in the long term. However, in the middle of this long-term period, are you guys willing to navigate through a 50% loss in your portfolio? Are you willing to experience one of this so called ´´lost decades´´ where stock returns where 0%? What if you need to withdraw some of the money periodically or an emergency arises? When we say the market always goes up, we often refer to the US stock market, but countries like Japan, with the Nikkei index, haven’t yet reached the 1990’s peak in 2023, to name one country…

The buy and hold strategy worked throughout history in the stock market, but isn´t as easy as it seems. I know plenty of friends and family newbie investors that moan about low investments or even losses in months or close to 1 year period, daily checking their not increasing portfolio, even when I previously warned them the risks and how things would likely be. About half of them end up selling their assets eventually, with the will of never returning to the markets again.

This is where an allocation close to the All Weather Portfolio can be a good option. All in all, we can never predict the future, and all our investment knowledge comes from the past. As Morgan Housel mentions in ´´Psychology of Money´´:

´´Realizing the future might not look anything like the past is a special kind of skill that is not generally looked highly upon by the financial forecasting community.´´

What´s the All Weather Portfolio investment strategy?

The All Weather Portfolio investment strategy consists in a fund containing the following distribution of assets to secure a safe return with low volatility, achieving good returns in spite of great turmoil periods like the ones triggered by black-swans (e.g. COVID breakdown):

- 30% US stocks

- 55% Bonds (40% long-Term Treasury / 15% intermediate-term treasury)

- 7.5% Gold

- 7.5% Commodities

According to Ray Dalio, this diversification of assets works in all the following macroeconomic situations:

- Inflation

- Deflation

- Bull markets

- Bear markets

In bull markets, stocks give amazing returns. When there’s inflation and prices rise, commodities and gold are the outperforming assets. In periods of deflation or bear markets, bonds work better than the whole market.

Here are two examples of intended All Weather Portfolios:

All Weather Portfolio Performance

This conservative portfolio has a great set of advantages:

- Low risk

- High diversification

- Low volatility

- Passive investment

But how about the historical returns?

Remember. Past returns are no guarantee of future performance, in fact, this is one of the reasons the All Weather Portfolio was created in the first place!

All Weather Bridgewater’s portfolio has been active since 1996, after years of investigation and testing.

Ray Dalio’s All Weather Portfolio had a 7.20% annual return (compounded). Depending on whether returns are measured adjusted for inflation, with compounding or the range (years) taken on account, if you investigate, these returns can vary from 5 to 9% annually, so be careful.

In the following chart by PortfolioVisualizer, we can clearly see the difference in performance with the 60/40 and S&P 500 portfolios.

In this next one provided by Ofdollarsanddata, we can see a different picture:

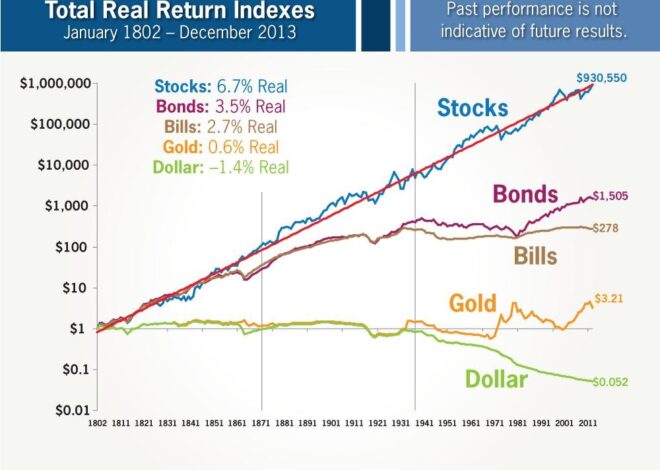

Don’t get me wrong, returns are extremely important when comparing investing options, however, as I once heard, ‘’If you prostitute the numbers enough, you will always get good results.’’, so be careful when you check numbers, and don’t be afraid of sometimes using logic and intuition. Look at the returns per asset class since 1802:

The difference in returns over time between these three portfolios is tight, and in my opinion, the three are great investment strategies. However, it’s obvious that a 100% stock portfolio could have better returns (thus higher risk) than a 60/40 or the All Weather Portfolio. If I had to make a comparison between these three strategies, it would go as follows (1 being the best suited portfolio):

The risk is the lowest for AWP, as the following drawdown chart shows:

AWP has also underperformed the 60/40, as low volatility has its cost:

To conclude, the All Weather Portfolio does outperform in bearish or slow growth periods, and carries less risk than other popular strategies. Nobody knows how the market will perform in the long run, soy this strategy is also a way to take cover from catastrophic events in the future.

How to create the All Weather Portfolio?

As seen previously in this article, retail investors cannot invest directly in the fund, however, it can be replicated by buying ETF’s regarding the portfolio allocations and rebalancing periodically. To create the All Weather Portfolio, we choose to do so by investing in low cost/highly rated ETF’s, which are accessible to every investor.

Try to study which ETF’s are convenient for you in particular; the following assets are an example, yet there are many possible choices to go with:

Remember to rebalance the portfolio accordingly to maintain the percentage of allocation in every sector. This is fundamental for the strategy to work!

Concept. Rebalancing means the buying or selling of assets to maintain a portfolio allocation. For example, if one year gold goes up more than the rest of the assets in your portfolio and ends up representing 15% of your All Weather Portfolio, you should sell enough to get it back to the 7.5% initial allocation.

Due to transaction costs, you shouldn’t do it very often. I would go for rebalancing quarterly, twice a year or even annually.

Who is the All Weather Portfolio ideal for?

Bridgewater’s All Weather Portfolio is ideal for investors who aren’t comfortable with volatility, or will be in the need of capital returns periodically. Risk averse investors who prefer low but safe returns are the ideal candidates for this kind of investment. In a nutshell, the All Weather Portfolio is ideal for the following investors:

- Risk averse investors

- Investors seeking low volatility

- Safe passive income over the long term

- Investors looking for returns in any economic scenario

- Retired/older people

Please tell me more about your excellent articles