ETF (Exchange Traded Funds): The best option for retail investors?

ETF (Exchange-Traded Funds) are financial instruments listed on the stock market that represent one of the best options for small investors who seek long-term investments, due to their low fees of management and significant diversification benefits, as well as excellent historical returns.

What is an ETF?

An ETF is a financial asset that seeks to replicate the performance of an underlying financial index by owning a collection of assets that make up that index.

As an example, one of the most popular ETFs for long-term investment is VOO, which attempts to replicate the S&P 500 index. Another example is Invesco QQQ, which tracks the Nasdaq 100 index.

ETFs follow their reference index in both the assets that compose it and their weighting; at the same time, any changes in assets and/or weighting are also replicated by the instrument.

How do ETFs work?

- Stock Exchange Listing

- Managed by Reputable Companies

- Intermediation through Brokers

ETFs are traded on the stock exchange at a fluctuating price, just like any other financial instrument. The most recommended ETFs are usually managed by reputable companies such as Vanguard, Blackrock, Fidelity, etc., who handle the management of the assets associated with the underlying index in exchange for a small annual fee.

These managed ETFs are offered to investors through brokers, who act as intermediaries providing the instruments and charge commissions for purchases, sales, and/or holdings.

What are the benefits of ETFs in comparison to other investments?

To begin with this analysis, we will study the benefits implied by investing in ETFs in comparison to other stock market investments, and why they represent one of the best alternatives for small investors. These are the main takeaways:

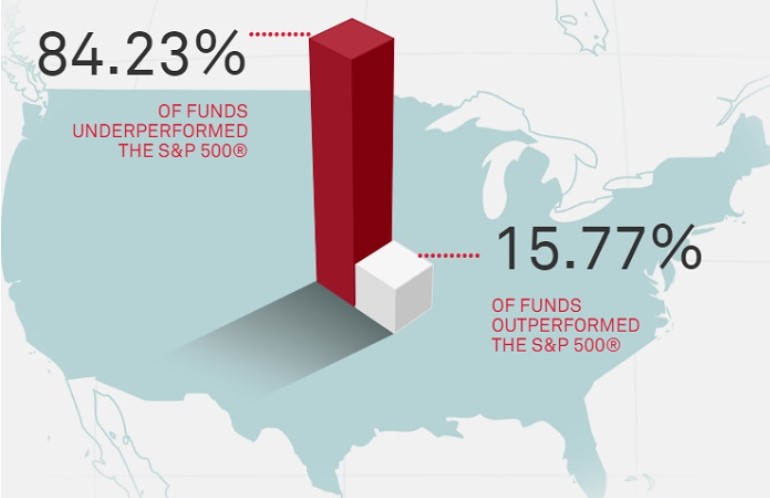

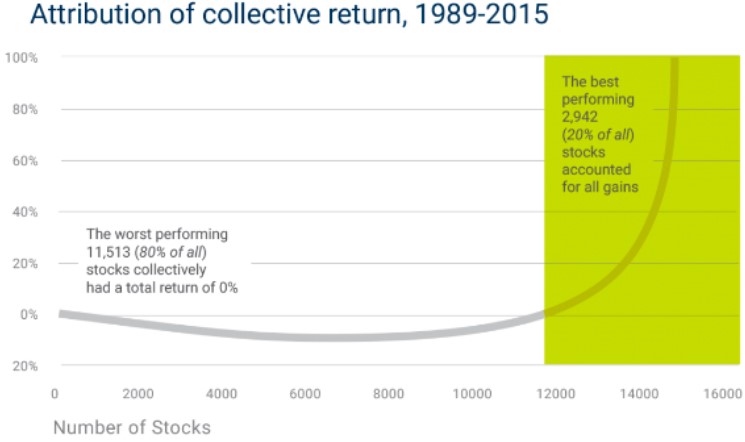

- Diversification. ETFs provide instant diversification by holding a basket of assets that represent an index or a specific sector. This diversification helps spread risk across multiple assets, reducing the impact of individual stock price fluctuations on the overall portfolio. In the following image, we depict how difficult it is to attempt to pick the winners from the market, as 80% of the stocks had a total return of 0% in a 25-year period:

- Low Costs. ETFs generally have lower expense ratios compared to mutual funds and other actively managed investments. These lower costs translate to higher returns for investors over the long term. According to Morningstar, the average ETF expense ratio is 0.23%, compared with the average expense ratio of 0.73% for index mutual funds and 1.45% for actively managed mutual funds (data from 2016).

- Liquidity. ETFs trade on the stock exchange throughout the trading day, offering high liquidity. Investors can buy or sell ETF shares at prevailing market prices, providing flexibility and ease of exit.

- Time efficient. The intrinsic passive type of investment in an ETF allows a ‘’set it and forget it’’ type of strategy, saving tons of time and knowledge from trying to trade or analyze by picking assets. An ETF works for you by selecting the best companies within a sector.

- Flexibility. ETFs cover a wide range of asset classes, from equities and bonds to commodities and real estate. Investors can choose ETFs that match their risk tolerance and investment objectives, catering to various financial goals.

- Accessibility. ETFs can be purchased through a brokerage account, making them accessible to individual investors with small amounts of capital. This ease of access opens up investment opportunities to a broader range of people.

- Tax Efficiency. ETFs tend to be more tax-efficient than mutual funds. Due to their unique structure, ETFs have lower capital gains distributions, which can result in reduced tax liabilities for investors.

- No Minimum Investment. Unlike some mutual funds or hedge funds, ETFs typically have no minimum investment requirement. This allows small investors to start investing with whatever amount they can afford.

- Real-Time Pricing. ETF prices are updated throughout the trading day, allowing investors to execute trades at any time during market hours and react to market movements promptly.

- Professional Management. Many ETFs are managed by reputable companies with experienced portfolio managers. Some of the biggest and most popular ETFs are managed by Blackrock (iShares), Fidelity, Vanguard and others.

Differences between ETFs and other classic investment vehicles

Below is a table comparing ETFs with other common investment vehicles, including mutual funds and individual stocks. The table outlines some key characteristics of each investment option to help understand their differences:

| ETF | Mutual Funds | Individual Stocks | |

| Diversification | Broad diversification by tracking index or sector | Variable, depending on the fund | Limited |

| Costs | Low | Medium/High | No expense ratio, but trading commissions and fees may apply |

| Liquidity | Highly liquid | Redemption delays may apply | Highly liquid |

| Transparency | Holdings disclosed regularly, providing transparency | Holdings disclosed periodically, may have a lag in reporting | Transparent, individual company information publicly available |

| Risk | Low | Medium | High |

| Accessibility | Accessible to individual investors with a brokerage account | Available to individual investors through fund companies | Accessible to individual investors with a brokerage account |

| Professional Management | Managed by reputable companies with experienced portfolio managers | Managed by professional fund managers | Requires individual research and decision-making by the investor |

| Minimum Investment | Often no minimum investment requirement | May have minimum investment requirements | No minimum investment requirement |

| Tax Efficiency | Generally more tax-efficient due to lower capital gains distributions | May have capital gains distributions that lead to tax implications | Capital gains taxed based on individual stock sales |

| Real-Time Pricing | Prices updated throughout the trading day | Valued based on end-of-day net asset value (NAV) | Prices updated throughout the trading day |

Source: Standard & Poors

How to Invest in ETFs?

- Choose a Reliable Broker. The first step to invest in ETFs is to select a trustworthy broker that offers the ETFs you are interested in acquiring.

- Authentication Process. To comply with regulations and anti-money laundering rules, you will likely need to go through an authentication or compliance process when opening an account with the broker. This may involve providing personal information and additional documentation.

- Transfer Funds. Once the authentication process is approved, you can transfer funds to your broker account. This can be done through a bank transfer or other payment methods accepted by the broker.

- Buy Assets. With funds in your account, you are ready to buy the ETFs you desire. You can search for specific ETFs by their name or symbol and make the purchase through the broker’s platform.

It’s important to remember that when investing in ETFs, you are acquiring a diversified basket of assets that track the performance of an underlying index. This allows investors to gain broad exposure to the markets without having to buy each individual asset. Additionally, due to their structure and low fees, ETFs have become a popular option for many investors. However, like any investment, it’s essential to conduct proper research and understand the risks before investing in ETFs.

How to Evaluate an ETF?

In the United States alone, there are currently over 3,000 ETFs trading on the stock exchange. There are those that bet on certain sectors decreasing in price (short ETFs), as well as those focused on niche industries like cryptocurrencies or bioengineering. For someone who is just beginning to venture into the world of stock market investments, the vast array of options can be somewhat overwhelming. Therefore, we will attempt to provide a framework of recommendations to the reader on how to choose the best ETFs for investing.

To determine the best ETF for investing, the following aspects should be evaluated:

- Costs and Fees. Consider the fund’s management costs (in the long term, even minimal differences become significant) and withdrawal fees.

- Performance. Study the past profitability of the ETF. Analyze its differences with the industry and take volatility into account.

- Risks. There may be risks related to the region, the currency of the fund, instrument closure, or regulatory risks.

- ETF Structure. Determine if the ETF is an accumulation or distribution type, or if it is leveraged on an index.

- Tracking Error of the Underlying Index. Monitor that the assets of the ETF closely match the underlying index.

- Company behind the ETF. It is advisable to stick with major players in the industry.

By carefully evaluating these aspects, investors can make more informed decisions when choosing ETFs that align with their investment goals and risk tolerance.

Types of ETF:

There are as many types of ETFs as there are ways to market them. The main categorizations are as follows:

- Equity ETFs. These ETFs are composed of stocks. For example, the S&P 500 is the most recognized equity index, consisting of the 500 largest companies in the United States. Generally, these equity funds comprise stocks from various themes, including sector-specific funds, geographic region funds, emerging markets, etc.

- Government or Corporate Bond ETFs. These fixed-income ETFs may track a set of debt issued by governments, companies, or international organizations. Certain categories are among the safest financial instruments.

- Synthetic or Derivative ETFs. These ETFs do not hold the underlying securities directly but use derivatives to replicate the index’s performance.

- Leveraged ETFs. They track a reference index but with leverage, meaning they aim to double or triple the returns, both in upward and downward movements.

- Cryptocurrency ETFs. These lack sufficient regulation, but some organizations issue them. They may track a set of cryptocurrencies or blockchain projects.

- Sustainability ETFs. These ETFs invest solely in assets that promote sustainability.

- Energy Index ETFs. These funds comprise values issued by companies in the energy sector.

- Precious Metals ETFs. These focus on investing in precious metals like gold, silver, etc.

- Commodity ETFs. These track the performance of a specific commodity or a basket of commodities.

- Forex/Foreign Exchange ETFs. They are related to currency trading in the foreign exchange market.

It’s essential to consider the specific objectives, risk tolerance, and investment preferences when choosing among the various types of ETFs. Each type serves different investment strategies and provides exposure to various asset classes or sectors.

Which ETFs pay dividends?

ETFs that pay dividends are those represented by stocks. ETFs with a distribution focus will pay dividends to the holder in cash. Certain ETFs target companies known for being dividend distributors.

Usually, ETFs closely related to emerging technologies or growth sectors are composed of stocks that reinvest their dividends (growth company stocks). On the other hand, ETFs that track more established companies tend to be dividend distributors.

There are ETFs that combine companies known for distributing dividends periodically, such as the SPDR® S&P UK Dividend Aristocrats UCITS ETF, which tracks the performance of companies with a strong dividend distribution record in the United Kingdom.

Which are the most profitable ETF?

First and foremost, it should be noted that higher returns come with higher risk. An investor should expect higher returns from a Bitcoin ETF, for example, than from an ETF of oil companies, but with that comes greater volatility and certainly greater risk.

Moreover, it should also be considered that past returns do not guarantee future returns, but they are the best way to evaluate the performance of a financial product.

Many ETFs have been created in the last few decades, so the track record can sometimes be unreliable in the long term. That being said, the ETFs that have achieved the highest returns in recent times are related to the two technology-related categories of companies that we will see below:

- Nasdaq. With an annualized return of 18.27% over the last 10 years, one of the best ETFs that tracks the Nasdaq 100 is the Vanguard Technology Fund (VGT). The Nasdaq 100 is an index that reflects the performance of the 100 most important technology companies in the United States. Another well-known ETF with excellent performance, and highly chosen by investors, is the Invesco QQQ.

- Semiconductors. The iShares Semiconductor ETF (SOXX) owned by Blackrock has had an annual return of 23.3% over the last 10 years. Used in the vast majority of electronic products, semiconductors have become an essential product in the technological revolution of the 21st century. Other ETFs with similar characteristics include the VanEck Semiconductor ETF (SMH) or the SPDR S&P Semiconductor ETF (XSD).

There are leveraged ETFs related to both sectors that can achieve much higher returns, but they come with significant risks. On the other hand, other sectors such as healthcare, biotechnology, and renewable energy have also performed well.

In any case, as economic paradigms constantly shift, investors should consider that the most profitable ETFs will also change over time.

Here are the best performing ETFs in the last 5 years according to a table developed by VettaFi:

I really appreciate your help

Thank you for writing this post!

May I have information on the topic of your article?

Very efficiently written article. It will be helpful to everyone who usess it, including myself. Keep up the good work – looking forward to more posts.

Generally I do not read post on blogs, but I wish to say that this write-up very forced me to try and do it! Your writing style has been amazed me. Thanks, very nice article.

Another thing I’ve really noticed is the fact that for many people, bad credit is the response to circumstances beyond their control. For example they may have been saddled through an illness and as a consequence they have high bills going to collections. It can be due to a work loss or maybe the inability to go to work. Sometimes breakup can really send the budget in a downward direction. Thanks sharing your notions on this site.

Its like you read my thoughts! You appear to grasp so much about this, such as you wrote the ebook in it or something.

I believe that you just can do with a few % to force the message home a little

bit, but instead of that, this is excellent blog. A fantastic read.

I will definitely be back.

Definitely, what a splendid blog and revealing posts, I definitely will bookmark your blog.Have an awsome day!