How to Become a Millionaire?

You’ve probably asked yourself this question many times throughout your life, and undoubtedly most of the answers you’ve heard or read about it are almost like fantasy events that defy the norm. The reality is that if you want to know how to become a millionaire, bear in mind that this is possible for anyone as long as you follow the steps to do so with a lot of discipline.

The first thing I want to do is demystify the ways to become a millionaire that I see spreading on social media and in various conversations. While it can happen, these represent fortunate cases that serve more as stories than exemplary reality. It’s normal to read that you can become a millionaire by:

- Trading

- Starting a startup

- Climbing the corporate ladder

- Investing in cryptocurrencies

- Buying lottery tickets

Real cases for these occurrences are one in a million. The reality dictates that the chances of becoming rich in these ways are almost nil. Clearly, creating a company (and I say company because 90% of startups don’t make it past three years) offers better chances of making good amounts of money, and it’s probably the best first step to becoming a millionaire.

However, the first lesson we must understand is this: an excellent salary, no matter how large, does not guarantee wealth. We all have acquaintances, or we’ve seen in the news how famous Hollywood actors or excellent professional athletes end up bankrupt due to mismanagement of their funds.

Taking the first steps

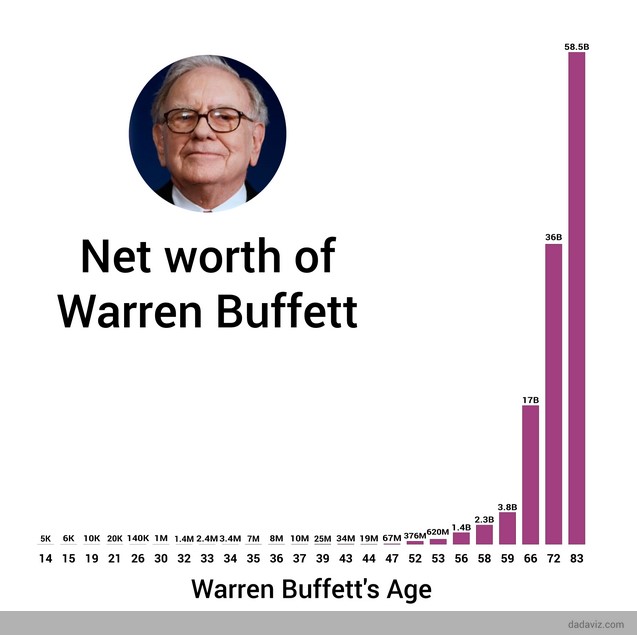

The first secret to becoming a millionaire is that you have to invest. Ideally, you should do some learning on this. The most significant attribute we have to consider is time. Warren Buffett is considered one of the greatest investors of all time and has been on Forbes’ list of the richest people on the planet for decades. He bought his first stock on the stock market when he was just 11 years old. Look at the chart below, which shows the evolution of his wealth over time:

He only reaches his first million at the age of 30, and the fruits of his work can be seen in his old age. Buffet still lives in the same humble property in Omaha and is not known for having big expenses in his day-to-day life. The golden years of Silicon Valley have created the dream of the young millionaire who develops a revolutionary idea, but the reality is different. The average age of the top 10 richest people on the planet according to Forbes in 2022 is 64 years. The second secret to becoming a millionaire is the time you’ve spent investing.

There are many ways to invest; the most common ones are as follows:

- In the stock market

- Real estate

- Real economy businesses

- Fixed-term bank deposits

A bank deposit today is not an investment worth considering, as the interest rates offered are very low, generally lower than the inflation rate. Real economy businesses, whether it’s an investment in a restaurant, hotel, market, and so on, are usually somewhat risky and require significant capital. The same goes for real estate investments; while they are a good and secure bet, they require a large initial sum of money. In the stock market, it is possible to invest in companies or entities with very little money. The secret is in choosing the right instruments without getting blinded by returns, which leads us to the third secret to getting rich: the higher the return, the higher the risk.

The Method

The most viable way for anyone on how to become a millionaire is to make periodic contributions to an investment plan in the stock market. These contributions, ideally monthly, will increase the amount invested over time, but the most important factor is that you will earn interest on your investments that will be reinvested in the stock market. This leads us to the fourth secret: take advantage of compound interest. Compound interest, according to Einstein, is the eighth wonder of the world. He said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” It works in such a way that, by having an asset that pays interest, these interests are reinvested in more assets that generate more interest. While the numbers may seem meager in the short term, the effect is seen over time.

An investment that yields a 10% annual interest generates a return of 100% of the capital in 10 years, but if you invested that 10% interest every year, the return would occur around the 7th year. If I gave you the choice between 1 million dollars or a penny that doubles in value every day for 30 days, what would you choose? Surprisingly, the penny would turn into about 2 million dollars on the 30th day.

The S&P 500 financial index includes the 500 most important American companies and is a recommended investment option for its historical performance. With an average return of around 9.5% per year, it represents an ideal instrument for those who need a passive investment with a good risk-return ratio, in a well-diversified, low-cost, accessible, and regulated instrument.

Regularly investing in a ETF that tracks the S&P 500 index is one of the most accessible ways to become a millionaire, as I mentioned, with patience and discipline. What the reader should do is save a small amount of money and make periodic investments regardless of the natural volatility of the market. While past returns do not guarantee future returns, the historical performance of the stock market shows a sustained increase in the value of shares over time.

Here is an example of a simple way on how to become a millionaire by investing in the S&P 500. In the graph, we start with the premise that initially, you invest 10,000 euros, and you contribute 200 euros monthly to the index, assuming its historical average performance:

As you can see, after 35 years from the start of the investment, you can accumulate 1 million euros. Obviously, it is possible to do this without an initial investment or by varying the periodic investment; the higher your saving power, the sooner you will reach the lucrative target. Here you can find some tips on how to get better with your personal finances.

And that’s it for today’s article. Here, you’ve seen a very simple, easy, and accessible way for everyone to become a millionaire, with no secrets or lies. If you believe there is any deficiency in what I’ve shown, you can do your research, which I always recommend for making financial decisions. However, you will likely confirm that this is one of the most truthful ways to become rich.

How to become a millionaire: wrapping it up

In summary, we’ve seen the real secrets on how to become a millionaire:

- Invest

- Have patience

- Higher returns mean higher risks

- Compound interest

Furthermore, we’ve also seen the way to accumulate one million euros: Invest periodically (ideally allocating a fixed monthly amount) in high-quality funds with diversification, such as the S&P 500 (Standard & Poor’s), and wait.

I’ve been browsing online greater than 3 hours as of late, but I by

no means discovered any fascinating article like yours.

It is pretty value enough for me. Personally, if all site owners and bloggers made good content as

you did, the internet will probably be a lot more helpful than ever before.