Personal Finances: 10 essential tips for healthy pockets in 2024

The foundation for effectively achieving financial success, is to manage your personal finances in a correct manner. This is why in this article we will explain in detail how to cope with your daily personal finances by providing useful tips to consider. The following is a curated list of essential tips to manage personal finances, and the arranged order was done on purpose, so you can follow it in a step-like manner.

1. Create a Budget (and be disciplined with it)

- Start by tracking your income and expenses, this could be done in Excel. It will give you a clear picture of where your money is coming from and where it’s going.

- Create a monthly budget that allocates specific amounts for various categories such as housing, food, transportation, entertainment, and savings.

- Automate bill payments to avoid late fees and penalties. Always pay your bills ASAP.

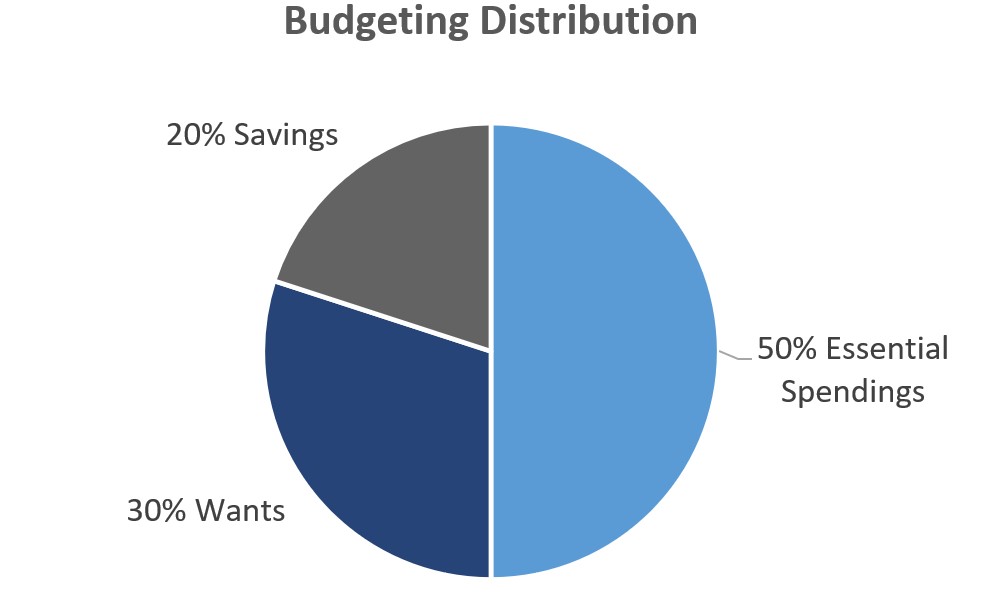

- Use the 50/30/20 budgeting rule: 50% essentials (food, utilities, rent, transportation), 30% wants (entertainment/travel), 20% savings (retirement, emergency fund, mortgage).

2. Live Below Your Means

- It’s easier to adapt your spending to a lower income if you spend less than you earn.

- Prioritize needs over wants when making spending decisions.

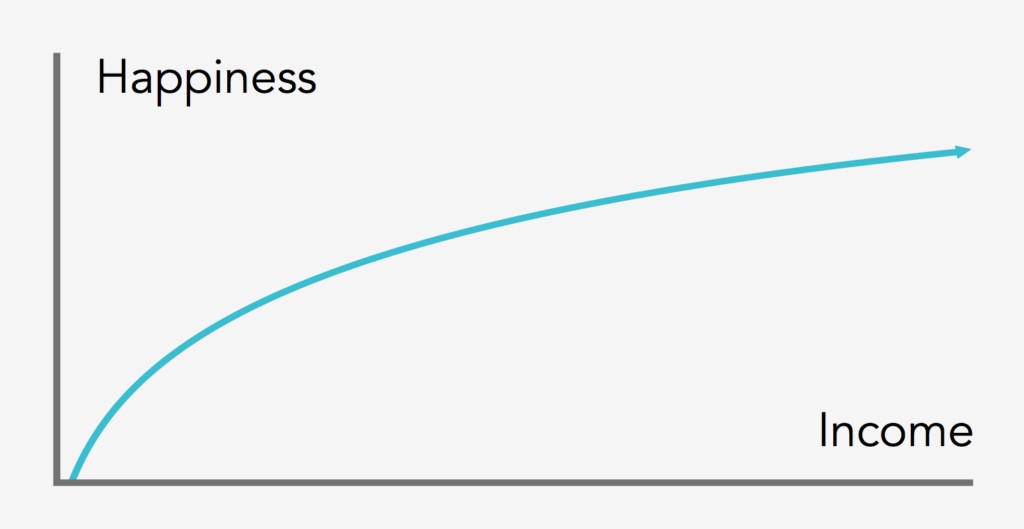

- The additional satisfaction from your wants is not as big as you think, in fact, financial peace of mind is definitely more important.

- The following graph resumes dozens of sociological investigations representing the relationship between income and happiness, the image speaks for itself:

3. Reduce your Expenses

- Negotiate prices and terms when making significant purchases, such as a car or home. Compare shops to find the best deals and discounts.

- Use cashback or rewards credit cards responsibly to earn benefits on your everyday purchases.

- Learn how to cook, not only it saves huge amounts of money, but you surely can get gains in health.

- Shop in quantity, goods widely used are cheaper when bought this way.

- Be mindful of recurring subscriptions and unnecessary expenses.

- Sometimes cheap means expensive; consider durability of goods.

- Avoid impulse purchases. Small, frequent expenses can add up over time. Keep an eye on daily habits like eating out, coffee runs, and impulse purchases, as they can impact your budget significantly.

4. Build an Emergency Fund:

- You should have availability in cash for approximately 6 months’ worth of current living expenses. This fund will provide a financial safety net in case of unexpected expenses or emergencies.

- Nowadays, no job is safe, and your dependents and you shouldn’t ideally rely on it as the only source of income (at least in the short-term).

5. Avoid/Reduce Debt:

- Prioritize paying off high-interest debts like credit card balances.

- Unless it’s essential, you should avoid ANY debts.

- As a general rule, avoid being indebted with payments that account for more than 30% of your monthly income.

- Avoid using credit cards unless they provide discounts or you really need to use installments; use debit cards or cash (bank transfer).

6. Start a retirement fund

- Retirement programs are heading towards huge financial problems in the future. Especially if you’re young, the risk of a total collapse in retirement public funds grows by the day. Chances are that you either get no pension at all, or you get a very poor income. World population is getting old and actively working people proportions are shrinking, especially in first world countries.

- It is becoming crucial to develop your own parallel retirement fund if you want to experience good quality life as a retiree.

- Start saving for retirement as early as possible to benefit from compounding returns (from investments).

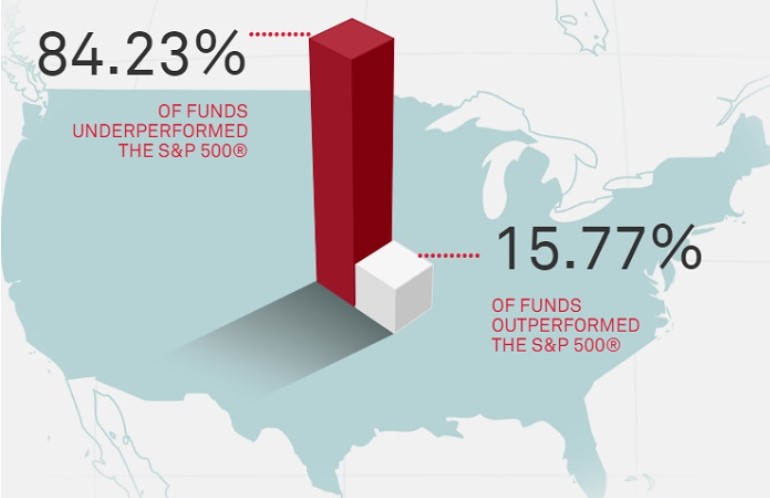

7. Invest your savings

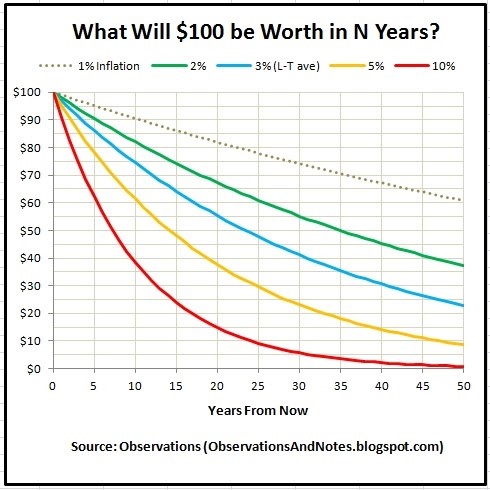

- Saving without investing is a huge error for your personal finances. Not investing your money will derive in huge losses in the long run. The dollar and any other fiat currencies carry inflation, which lowers the value of your savings year by year.

- Assuming a 3% yearly inflation of any currency, the value of $1.000 will turn to $500 in 20 years, that’s a 50% loss for having your money sitting on your bank account, and 3% is a very generous inflation number, considering our ever-spending-indebting governments of these modern times.

- If you are wondering how to invest, this website can help you a little bit ; ) .

- Set up automatic transfers (or do it manually with discipline) to your investment accounts. This ensures that you consistently invest without having to think about it.

- Save and invest more money while you are young. Lower your risk in investing and reduce the saving proportion amounts while you get older.

8. Invest in yourself too

- Any money spent on courses, skills or studies can increase your income, thus improving your personal finances. Take it as an investment.

- Start a side hustle. Depending on one stream of income (aka your daily job) is risky, consider alternatives.

- Investing in yourself can bring peace of mind and open your career to a world of opportunities. Why investing so much effort to get healthy pockets if we have no mental health?

9. Plan accordingly for the future

- Effective personal finances require planning.

- Define short-term and long-term financial goals. Having specific objectives can help you stay motivated and focused on your financial journey.

- Regularly review and adjust your goals as your circumstances change.

- Anticipate major life events, such as buying a home, getting married, having children, or kids’ education. Save and plan accordingly to minimize financial stress.

10. Avoid lifestyle inflation

- As your income grows, resist the temptation to dramatically increase your spending. Instead, continue living modestly and save the additional income (you can increase your savings rate further from the classic 10-20%).

- Use bonuses, raises, or windfalls for investing rather than splurging on unnecessary expenses.