On the reasons to learn how to invest

An overview exploring why everyone should be investing and how to do it efficiently.

According to JP Morgan, the retail investor makes, on average, a 3.6% of annual return over their portfolio, while the classic 60/40 portfolio (60% invested in stocks and 40% in bonds) returns 7.4%. If you don’t want to be an average investor, you should learn how to invest efficiently.

Actually, the average historical annual return of the entire stock market is 7% after inflation. So, what are we doing wrong? Is it worth spending hours of our time trying to figure out how to maximize our returns?

How are actively managed hedge funds better than us? Are they?

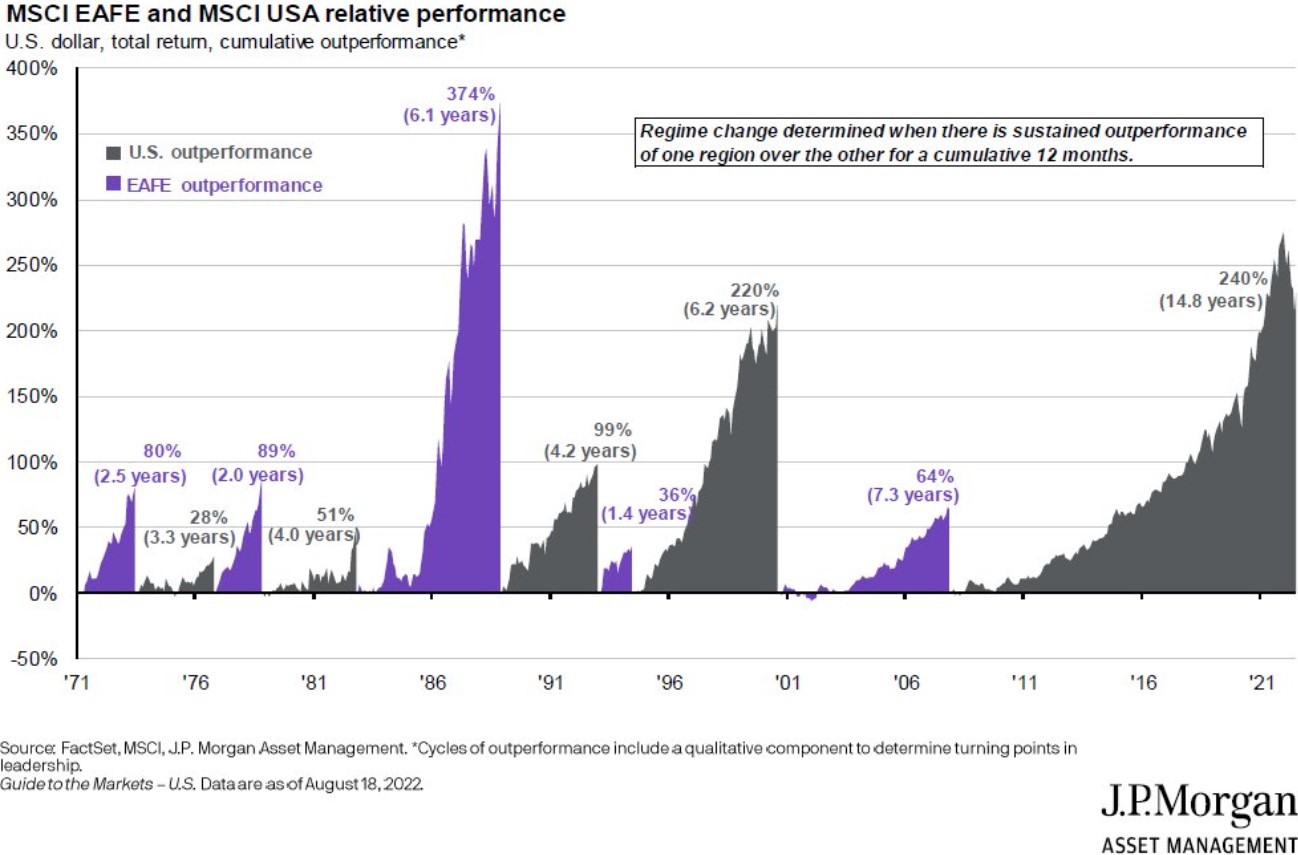

Image extracted from J.P. Morgan

Warren Buffet, one of the greatest investors ever, made a million-dollar bet in 2008 which implied that no hedge fund could beat the S&P 500 (index that tracks the price of the 500 biggest companies in the US) in a 10-year period. A hedge fund, Protégé Partners LLC, decided to take the bet and lost.

Apparently, hidden and supposedly small fees scale the cost in the long term, affecting returns considerably. Besides, as you will learn in this website, trying to time the market and active portfolio management are extremely difficult jobs to get done right.

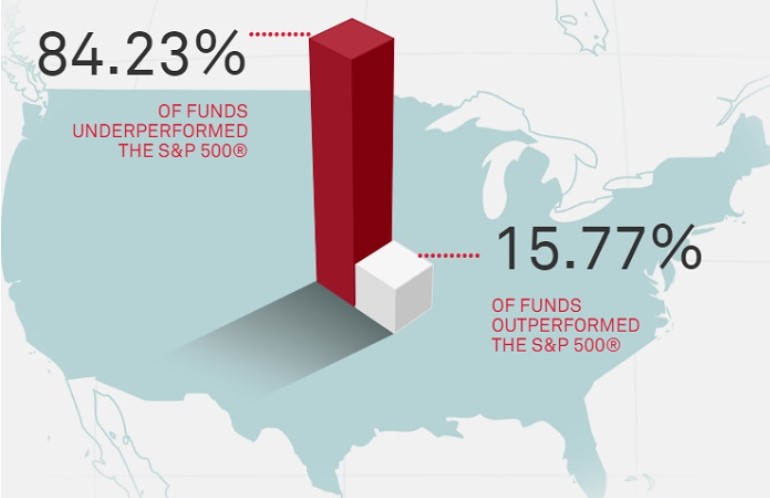

Another inconvenient truth is the minority of hedge funds (money managers that actively invest in the markets to beat the market returns) can make better returns than the market in the long run, as shown in the image below:

This means that Wall Street giants, with tons of money, the best talent at hand and all the insider information we could never reach, can’t beat the market either.

So, what can we do? Park the money in the bank so its value gets slowly eaten by inflation? Check out the following graph depicting the evolution of a portfolio by saving vs investing (in S&P 500) over time:

Nowadays, more than ever, the importance of investing is summarized in the following essentials:

- Preservation and development of wealth

- Retirement

- Safety and freedom

In The Modest Investor, we help you navigate this complicated path through education, comparisons, providing the necessary tools and updates.

Buckle up and join us on this bumpy ride heading towards your financial freedom. Learn how to invest for free.

Займ через Госуслуги: моментальное решение для ваших срочных нужд

займ через госуслуги на карту без отказа https://zajm-cherez-gosuslugi.ru/ .