The incredible performance of S&P 500 index (and how to adopt it as an investment strategy)

The S&P 500, or the Standard & Poor’s 500 Index, serves as a prominent yardstick for measuring the performance of the American stock market. It encompasses 500 prominent publicly traded companies, showcasing a broad spectrum of industries and economic sectors within the United States.

S&P 500 historical price by Google Finance

The selection process for its constituents is carried out by the Standard & Poor’s index committee, which evaluates criteria like a company’s market value, trading liquidity, sector representation, and financial stability.

As a market-capitalization-weighted index, the S&P 500 places more significance on the performance of companies with larger market values, in contrast to indices like the Dow Jones Industrial Average that are based on share prices.

The S&P 500 stands as a crucial benchmark for investors and financial analysts, offering insights into how investment portfolios are faring and providing a barometer for the general well-being of the U.S. stock market.

KEY TAKEAWAYS

- 10.15% is the annual return of the S&P 500 since its inception in 1957 to 01/01/2023

- Adjusted for inflation, the average annual return in 8.5%

- The median P/E of the index is 17.85 as of 17/08/2023

- Any investor can invest in the index ideally through low-cost ETFs

6 Reasons why the S&P 500 is one of the best performing indexes

With an eye-opening 10.15% annual return since the 1950’s, the S&P 500 is one of the best performing indexes of all time, and such a long record solidifies its position as one of the most chosen investment assets the world has to offer. Next, we provide 6 reasons why the S&P 500 is one of the most successful indexes:

- Tracks the performance of the largest economy in the world. USA has one of the world’s largest and most influential economies.

- Consists of outperforming businesses. The S&P 500 is market-capitalization-weighted, which means that companies with larger market capitalizations have a greater influence on the index’s performance. This approach aligns with the market’s natural hierarchy, where larger companies tend to have a bigger impact on the overall market. The S&P 500 companies are well-positioned to benefit from the US economic strength and growth, contributing to the index’s performance.

- Includes the biggest businesses in the world. The index not only possesses great performing stocks, most are within the biggest businesses in the world. Within the 10 biggest companies by market capitalization, 9 are part of the S&P 500, which include Apple, Microsoft, Google, Amazon and Meta.

- Solid historical performance. Over the long term, the U.S. stock market has shown a tendency to grow. The S&P 500, being a reflection of this market, has delivered relatively stable and positive returns over time, making it an attractive choice for long-term investors. Besides the historical time span since the index started operating is wider than most of the ETFs in the market, with many that are relatively new.

- Availability. Investing in the S&P 500 is relatively easy for individual investors. There are numerous index funds and exchange-traded funds (ETFs) that track the S&P 500, making it accessible to a wide range of investors. Besides, the costs of ETFs and funds attached to the index have very low associated costs.

- Allocation. The S&P 500 represents a broad cross-section of the U.S. economy. It includes 500 of the largest publicly traded companies across various sectors, such as technology, healthcare, finance, and consumer goods. This diversification helps spread risk and reduces the impact of poor performance by any single company or sector.

The S&P 500 is one of the heaviest-weighted assets even in Warren Buffet’s Berkshire Hathaway or Ray Dalio’s Bridgewater Associates. A big chunk of the world greatest investors owns the index as an influential asset in their portfolio.

Despite the excellent performance of S&P 500 on record, remember that past performance is not indicative of future results. As investors, you should be aware at possible economic changing orders.

Is it worth trying to pick outperforming individual stocks?

According to Morgan Housel in his book ‘’Psychology of Money’’, 40% of all the companies that get to be publicly traded lost all of their value over time. Choosing winning assets is extremely hard, even to hedge fund managers that are deeply prepared for it. The following picture by Standard & Poors shows how hedge funds did against S&P 500:

A study by JP Morgan found that from 1980 to 2014:

- 7% of all the traded stocks accounted for all of the market’s gains

- 64% of stocks underperform their benchmark index

- 40% of stocks showed losses

The following graphic clearly depicts how picking stocks could perform for the average investor:

In 2008, Warren Buffett, the legendary investor, placed a million-dollar bet. This bet essentially asserted that no hedge fund could outshine the S&P 500, which tracks the fortunes of the 500 largest US companies, over a span of ten years. Protégé Partners LLC, a hedge fund, took up the challenge and, in the end, came up on the losing side of this wager.

‘’Excuses make today easy, but tomorrow hard. Discipline makes today hard, but tomorrow easy’’

Which is the best performing type of asset historically?

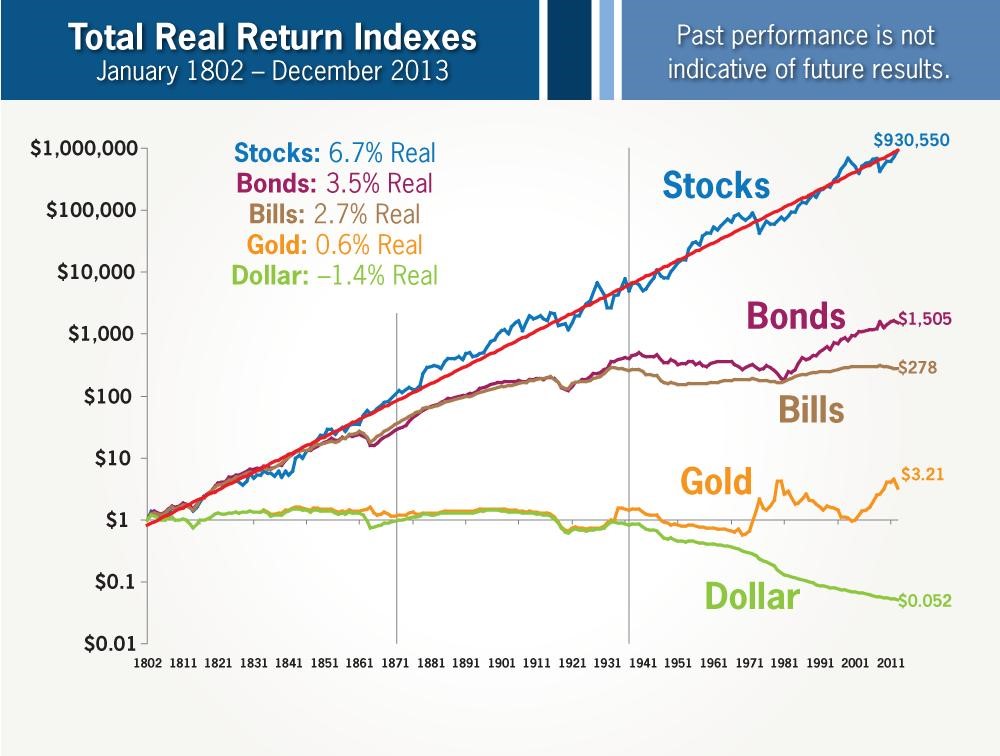

The best performing assets of all time are stocks, and this is no mystery: every portfolio manager knows that to get juicy returns from a portfolio, holding stocks is essential. The following graphic extracted from Brian Feroldi’s X account presents the outperformance of stocks:

This is yet another reason to support the S&P 500’s returns, as the index only includes stocks within its assets. With the exception of the new shiny asset class, cryptocurrencies, no other type of asset performed better (historically) than stocks.

Considerations and risks

Every investment has its risk, and remember one of the most important financial laws: big returns mean bigger risks (and vice versa).

- Market dependence. Since the S&P 500 is correlated with the overall market, it can be affected by market downturns, resulting in potential losses during bear markets. If you can stand the following historical drawdowns, it’s probably not for you:

- Limited international exposure. The S&P 500 focuses exclusively on U.S. companies, which means you miss out on potential growth opportunities in international markets. There are world ETFs, yet US stock performance is unparalleled to this date.

- Could be overvalued. In the last decades, its P/E ratio has been quite high, even in relation to its historical average.

- Overweighting of larger companies. Being market-cap-weighted, the S&P 500 gives more influence to larger companies, which might not always represent the best growth potential.

- Passive management. The fund isn’t actively managed, meaning some potential gains will not be captured. Historically, the indexes had outperformed the actively managed hedge funds in the long-run, however, in periods of downturns, hedge funds had outperformed stock indexes, as Bloomberg’s below image indicates:

How to invest in S&P 500?

Investing in the S&P 500 can be a very easy thing to do, all you need is to open an account in a brokerage and buy an ETF that tracks the index. Personally, I invest in Vanguard’s ETF VOO, which has a very low expense ratio, the company has a high reputation and liquidity is very high. Also, you can find this ETF in most asset brokers.

Some techniques to apply when investing in the S&P are the following:

- DCA. Dollar cost averaging consists in buying a fixed amount periodically. This could be in a month-to-month basis, quarterly or even once a year. It is common to do it periodically as you can invest whatever you save from your regular income. This strategy is essentially passive, as you buy in high or low prices. It has proven to be one of the most effective ways to invest in the stock market, as timing the market is an extremely difficult thing to do.

- Lump sum investment. If for any reason you get an important amount of money and want to invest it in S&P 500, this is also a very valid strategy. In fact, the sooner you start investing in life, the better. Stocks go up un the long run, so if you buy and hold enough time, the probabilities of losing money (according to historical performance of S&P 500) are very low.

Important. Don’t try to time the market! This means trying to buy when the index’s price falls. It is more likely that you end up loosing money by waiting for the market to go down. Nobody, event the most experts can time the market effectively, no one knows when it’s going up or down. Besides:

TIME IN THE MARKET > TIMING THE MARKET

Another riskier way to invest in the index is with alternative strategies that try to outperform the index per-se:

- Equal weight ETFs. One of the S&P 500 variants are ETFs that provide equal weighted funds, in market capitalization, for all 500 companies involved in the index. Remember that the classic S&P 500 is weighted; the larger the company, as defined by the value of all outstanding shares, the larger the weight in the Index. As of 2023, Apple’s (biggest company) index weigh is about 7.5%.

- Leveraged ETFs. Another alternative is to buy leveraged S&P 500 ETFs, could be x2 or x3. This is extremely risky, as the potential to go up, can also mean potential for bigger drawdowns.