The 60/40 portfolio: one of the most popular investment strategies

Small investors experience a rough fight when trying to beat the markets. In fact, according to JP Morgan, individual investors underperform the market as show in their graph below:

Hedge funds, wall street, quantitative businesses and powerful people often feed from retail investor’s errors. This is why a passive approach could be the ideal path for us small investors; this means to follow the markets, which usually beat even the biggest hedge funds. Enter the 60/40 portfolio strategy.

Within the ever-growing asset universe, we encounter a wide range of options that could be a little bit overwhelming if you are no expert in the markets. When this is the case, the best we can do is to keep it simple. If you are going for day trading (a form of active investing), you better make a living of it and start studying, even then, the odds will be against you (big time!).

If this is not the case, the best you can do if you are going to invest in the stock markets is to choose a passive investment strategy to pile your money in. You’ll also need a lot of patience, as there is no easy money in here to be made. Yes, you can get rich investing in the stock market, but it is a long journey and it depends on your income. Expect a journey that will last at least a decade, the sooner you begin, the better.

Insight. Time in the market > timing the market.

Enough with the chatter. Let’s get into the 60/40 balanced portfolio, one of the most – if not the one – chosen strategy for passive investing.

What is the 60/40 investment strategy?

The 60/40 investment strategy, also known as the “60/40 portfolio” or “60/40 rule,” is a widely recognized and classic asset allocation approach used by investors to balance risk and returns within their investment portfolio. The strategy involves allocating 60% of the portfolio’s assets to stocks (equities) and 40% to bonds (fixed-income securities). This ratio is considered a guideline rather than a strict rule, and investors might adjust the allocation based on their risk tolerance, financial goals, and market conditions.

Here’s a breakdown of the two main components:

- Equities (60%): This portion of the portfolio is invested in stocks, which represent ownership stakes in companies. Stocks are generally considered higher risk investments that offer the potential for higher returns over the long term. The equities component can include both domestic and international stocks, across various sectors and industries. The goal of the equity allocation is to capture the growth potential of the market and benefit from capital appreciation as companies expand and increase their value.

- Bonds (40%): The bond allocation consists of fixed-income securities such as government bonds, corporate bonds, municipal bonds, and other debt instruments. Bonds are generally considered lower risk investments compared to stocks and are known for providing regular interest income. They also tend to be more stable and can act as a buffer during periods of market volatility. The bond component is intended to provide income and potentially reduce the overall portfolio’s volatility.

The rationale behind the 60/40 investment strategy is to create a balanced portfolio that combines the growth potential of stocks with the stability and income generation of bonds.

The 60/40 performance over time

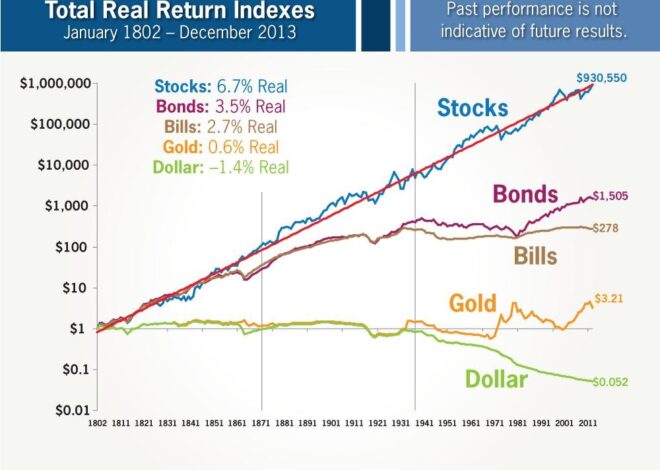

The historical performance of the 60/40 strategy has averaged a 6% return annually, which can vary depending on chosen assets and years which you had been invested in the market. This returns are a bit lower than the performance of S&P 500 but notably higher than a 100% bond strategy.

In the following table provided by Charlie Biello via X (Twitter), you can analyze the performance of the strategy since the late 70’s:

Main characteristics of this portfolio strategy

The 60/40 investment strategy is often considered one of the best alternatives for long-term investing due to several key factors that contribute to its appeal and potential effectiveness:

- Diversification: The strategy combines both equities and bonds, which are historically negatively correlated assets. This means that when one asset class (e.g., stocks) is performing well, the other (e.g., bonds) might not be performing as strongly, and vice versa. This diversification helps reduce the overall volatility of the portfolio, making it more resilient during market fluctuations.

- Balanced Risk and Return: By allocating a significant portion (60%) to equities, investors can potentially capture the long-term growth and higher returns associated with stocks. At the same time, the 40% bond allocation provides stability, income, and acts as a buffer during market downturns, helping to manage risk. This balance between riskier and more stable assets can lead to smoother overall portfolio performance.

- Risk Management: The bond component of the portfolio helps mitigate the impact of severe market declines. Bonds tend to be less volatile than stocks and often perform well during periods of economic uncertainty or market stress. This can provide a cushion for the overall portfolio’s value, reducing potential losses during market downturns.

- Income Generation: The bond portion of the portfolio generates regular interest income, which can provide a steady stream of cash flow even in volatile market conditions. This income can be particularly beneficial for investors who are relying on their investments for retirement or other financial goals.

How to invest in the 60/40 portfolio?

Investing in a 60/40 portfolio involves selecting and allocating assets according to the 60% equities and 40% bonds ratio. To develop your own 60/40 portfolio, you should:

- Choose Equity Investments: Select a diversified range of equity investments to make up the 60% allocation. This can include individual stocks, exchange-traded funds (ETFs), or mutual funds. Consider investing in different sectors, industries, and geographic regions to enhance diversification.

- Select Bond Investments: Choose a mix of fixed-income securities for the 40% bond allocation. This can include government bonds, corporate bonds, municipal bonds, and Treasury Inflation-Protected Securities (TIPS). You can also use bond ETFs or mutual funds to gain exposure to a variety of bonds.

- Rebalance Regularly: Over time, the performance of equities and bonds can cause your portfolio to deviate from the 60/40 allocation. Periodically rebalance your portfolio to bring it back in line with the desired allocation. Rebalancing involves selling assets that have performed well and buying assets that have underperformed.

It is of great importance that you consider a long-term perspective, as results for a safer strategy like this one give results in longer periods of time. Market conditions can change often, so it’s important to stay updated, even if the strategy involves passive investing.

Here are two examples with real assets, yet you should do your own diligence:

What are the pros and cons of the 60/40 portfolio?

The 60/40 portfolio, like any investment strategy, comes with its own set of advantages and disadvantages. Here’s a breakdown of the pros and cons of the 60/40 portfolio:

PROS:

- Diversification: The allocation to both stocks and bonds provides built-in diversification, helping to spread risk across different asset classes. This can reduce the overall volatility of the portfolio.

- Stability: The bond component provides stability and acts as a buffer during market downturns. This can help preserve capital and prevent investors from making impulsive decisions in times of market stress.

- Income Generation: The bond portion generates regular interest income, which can be beneficial for investors seeking a steady income stream, such as retirees.

- Long-Term Growth Potential: The equity portion of the portfolio allows investors to participate in the long-term growth potential of the stock market. Over time, stocks have historically shown the potential for significant capital appreciation.

- Simplicity: The 60/40 portfolio is relatively easy to understand and implement, making it suitable for investors who prefer a straightforward approach to investing.

- Behavioral Benefits: The balanced nature of the portfolio can help prevent investors from making emotional decisions based on short-term market fluctuations. The stability of bonds can provide reassurance during market volatility.

CONS:

- Lower Returns: While the 60/40 portfolio offers a balance between risk and stability, it might generate lower returns compared to a more aggressive all-equity portfolio during strong bull markets.

- Interest Rate Risk: The bond component of the portfolio is subject to interest rate risk. If interest rates rise, the value of existing bonds may decline, leading to potential capital losses.

- Inflation Risk: Fixed-income securities, particularly bonds, might not provide the same level of protection against inflation as equities. Inflation can erode the purchasing power of fixed interest payments.

- Changing Market Dynamics: The historical performance of the 60/40 portfolio might not accurately predict future performance due to changing market dynamics, economic conditions, and interest rate environments.

Alternatives to the 60/40 portfolio

The 60/40 investment strategy is considered as a safe investment, ideal for people looking for long-term returns with low volatility. The risk is lower than other alternatives and could be better suited for people in the final decades of their careers, or people very risk-averse or in the need of regular income.

If you are in your 20s of 30s, you could take more risk, as you still have a long period of working age time to make up for any possible losses. A widely used rule in investing is the 110, where you tailor your asset allocation based on your age. It involves subtracting your current age from 110. This calculation offers a suggestion for how to divide your investment between equities and bonds. As an illustration, if you’re 40 years old, you might allocate 70% of your portfolio to stocks and reserve the remaining 30% for bonds.

Portfolio construction doesn’t come in a single mold. Some investors might lean toward distinct proportions, like 70/30 or 50/50, while others might introduce additional asset types such as real estate, commodities, or alternative investments to amplify diversification, potentially boosting returns and curbing risks. One popular risky and simple alternative could be to invest in historically high return US large-cap stocks. We explore this strategy in another article.

I’m so in love with this. You did a great job!!