US assets: Why are they the biggest holding of funds and indexes across the world?

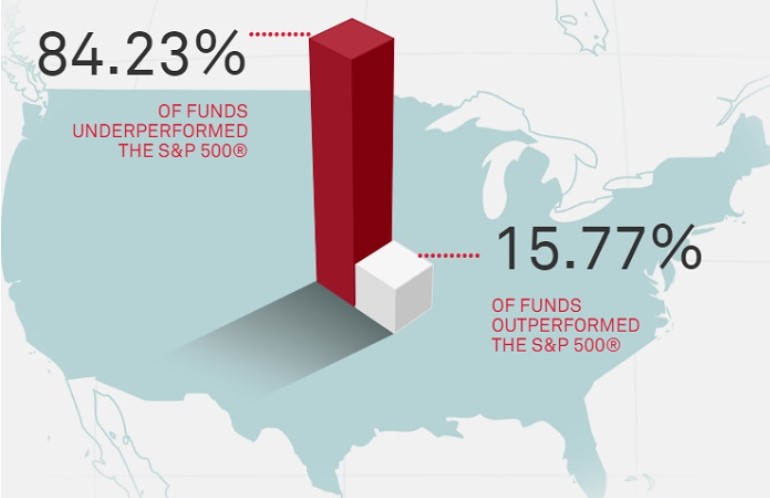

There are reasons why the vast majority of the money invested in the stock markets goes to US assets. If you study the world’s main funds, it’s not surprising to see US holdings as the biggest portion of the fund’s portfolio. Even worldwide funds, like Vanguard Total World Stock Index Fund (VTWAX) which manages almost $40 billion, have a 63,3% exposure only to North America.

These are the top 4 holdings of Blackrock’s iShares MSCI ACWI UCITS ETF, an all-world fund:

Surprise! they’re all American companies.

The market is simple, and demand usually goes to good performing assets. Besides many menaces over time; like the rise of Japan as the world’s manufacturer, the upswing of the USSR, the ascent of China or even the BRICS; no entity could dispute the dominance of the USA.

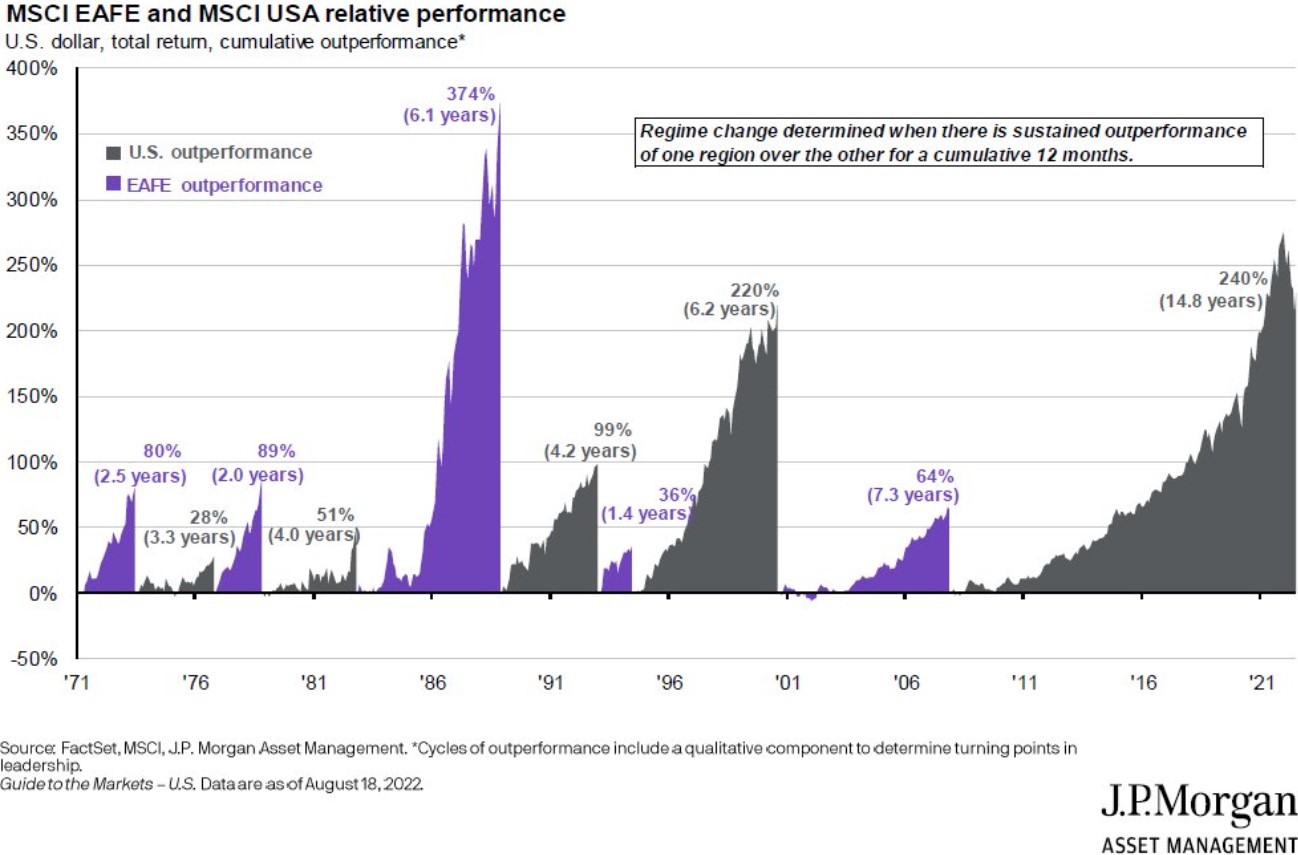

In the following graph by J.P. Morgan, we can clearly watch how U.S. company’s returns outperform the rest of the market the majority of the time:

The superior performance of U.S. assets over time

There are many reasons that explain why US assets outperform the rest of the world. Essentially, we can resume them in the following:

- The world largest economy. United States has been the main economic engine since the early nineties, and data indicates its position isn’t even being challenged.

- It has the largest stock exchanges. The two largest exchanges are from the US: NYSE and NASDAQ. These are the 6 largest stock exchanges in the world (data from 2023) by market capitalization:

| Exchange | Market cap. (trillions of dollars) |

| New York Stock Exchange (NYSE) – USA | 24.3 T |

| NASDAQ – USA | 20.13 T |

| Shangai Stock Exchange (SSE) – China | 6.93 T |

| EURONEXT – EU | 6.42 T |

| Japan Stock Exchange (JPX) | 5.63 T |

| Shenzhen Stock Exchange (SZSE) – China | 4.67 T |

- Currency domination. The US dollar is still the world reserve currency, widely used by every country as the default exchange currency. The hegemony of the greenback is close to achieving 100 years of domination. There are some menaces but at the moment it’s difficult to identify a potential competitor.

Will the throne have any claimants?

The main question could be if actually we will live to experience a shift. Like we’ve seen in the last image depicting the history of the world’s reserve currencies, it could happen that we see a major shift in the system. Ever-ascending debt in the US, the confluence of other powers or a wake-up call for a long-awaited globalization promoted world currency could present a menace for the US supremacy.

The main threats for the US supremacy could the following (high personal speculation here!):

- India

- The fall of US dollar

- Exponential growing debt

India could be a silent monster which grows day by day. Currently, they dispute the world’s biggest population. The Sensex index, which tracks India stock, has grown 313x with CAGR of 15.46% in the span of 40 years since 1979. India’s GDP Growth rate has been between 6 to 7% in the last 10 years. The country, in contrast to other disputers in the likes of Russia or China, has a solid democracy and a neutral stand towards the rest of the world, and population growth differs positively in contrast to Japan’s case. The Indian diaspora makes relationship and communication a major advantage.

On the other hand, the US population is still growing, with immigration being one of the main forces in the working population. It is important to note that population growth, logically, usually goes hand-in-hand with economic growth in the long run, as a growing population increases production and consumption. This graph provided by Newgeography.com provides a solid outcome for the US working population:

On the other side, new currencies, CBDC’s or cryptocurrencies could signify potential winners of the coinage hegemony in the long run. After all, it’s kind of weird that a currency emitted at will by only one country makes an ever-globalized world fall short on necessities. Besides, uncontrolled inflation (fought with astonishingly big debt emissions) and banking restrictions, as well as an expensive, slow and hyper controlled financial system is becoming a burden for many.

As for the economy, no country has developed the entrepreneurship money making machine that United States has developed. The country is home to the world greatest businesses, and welcomes the world greatest talent. Besides, US accounts for many of the world’s best universities, welcoming the greatest students from all over the world. The openness of the country toward businesses makes it very safe for growth, and investors money flows like anywhere else. Whether a country can become such a great hub for businesses, I humbly think at the moment, none is even close.

How can we investors be prepared for a possible shift?

If you are well diversified and hold worldwide assets, this shouldn’t be a problem, as you would benefit from any kind of change. Furthermore, if you hold world funds, their holdings will change accordingly as the economic power changes hands. A slow fall in US stock could be devastating too, so you should cover this scenario too. The best options to be correctly prepared are the following:

- Buy world tracking ETFs. They hold assets from businesses all over the world)

- Invest in big cap cryptocurrencies. Don’t go big on this, but the potential upside could be huge.

- Consider Ray Dalio’s All Weather Portfolio. The founder of Bridgewater Associates, one of the best investors of all times and writer of the bestselling book ‘’Principles’’, created a portfolio that could go through every possible ‘’storm’’, heavily mitigating market risk. However, although having very low risk/volatility, even his portfolio’s allocation is heavily influenced by US assets.

- Buy emerging markets ETFs. Watch out for southeast Asia, the biggest growing population (they will have the largest young working population in the world).

Be careful. I believe United States stock market still has a strong period of predominance in the near future, maybe, millennials like I will not even live to see a new world leader. If you invest in the stock market, I wouldn’t leave US out of my portfolio, in fact, I’m heavily invested in it, as results have been undefeated in the last decades.

The articles you write help me a lot and I like the topic

I enjoyed reading your piece and it provided me with a lot of value.

Thank you for writing this post!

I抳e learn a few just right stuff here. Definitely worth bookmarking for revisiting. I wonder how so much effort you put to create this sort of magnificent informative web site.