Which are the best ETFs to invest in 2024?

As we said in this article about ETFs, this investment vehicle carries tons of benefits for investors, specially when we are in search for long-term passive investments. There are many types of ETFs in the market, and many companies that distribute them. Of course, it’s hard to look for astonishing returns (at least in the short and medium term) when buying an ETF, however, one of its main benefits is diversification. If you want to know which is the best ETFs to invest in 2024, firstly, define your risk aversity.

When you buy an ETF, you are acquiring many companies related to a certain sector. If you are looking for the best ETFs to invest in 2024, you have to know something very important in the stock market:

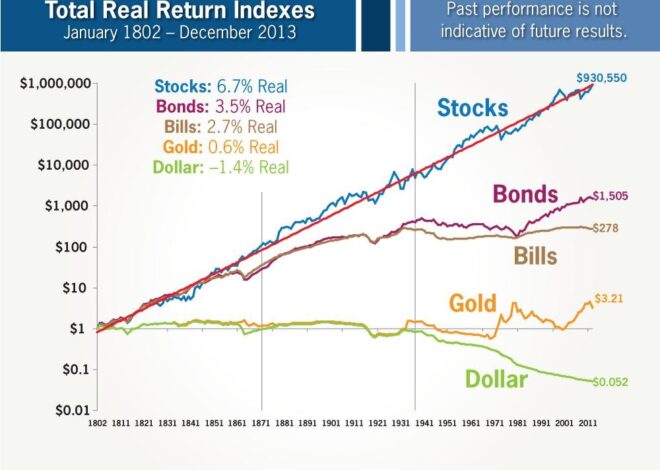

Past performance is no guarantee of future results.

Black swans occur all the time, besides, technology evolves at an exponential rhythm, delivering unexpected results. This is actually an argument in favor of choosing to invest in diversified assets life ETFs, as stock picking becomes more difficult day by day.

S&P 500 historical performance

Look at the historical performance of the S&P 500. Even in 60 years, the annual growth rate is amazing. This ETF is one of the best performing assets within the entire history of the stock market. Tracking the 500 biggest companies in the USA, the index accompanied the phenomenal growth of the US as none other asset has done. If a company rises in market capitalization more than a company involved in the index, they switch places. This gives investors the possibility to maintain only great companies.

Be careful: S&P 500 is an index, certain ETFs track its performance, for example, SPY or VOO.

Best ETFs to have in your portfolio

Choosing the best ETF to invest in 2024 depends widely on many factors, as the investor’s necessities, the duration of the investment, as well as other risk issues (remember that higher expected returns mean higher risks).

Considering good ETFs as low cost, high liquidity, bigger than average returns, risk, and funds managed by reputable companies, the following are some of the best ETFs to invest for the long run:

- Vanguard S&P 500 ETF (VOO). With a humble 0.03% expense ratio, this fund includes the 500 biggest publicly traded companies (by market capitalization) in the US. The S&P 500 performance can be tracked since 1926, and had an annual average return of 10,16%, or 6,99% adjusted for inflation. This is a great historical performance return, which proved consistent even transitioning the toughest financial crises like the ones in 1930, 1974, 2001 or 2008.

- Invesco QQQ Trust (QQQ). Technology has been the engine of economic growth for a couple of decades, in fact, the biggest companies in the US come from this sector. Invesco QQQ Trust tracks the Nasdaq 100 index, which follows the biggest tech companies. With a bigger risk and volatility than S&P 500 (but more potential returns), it includes companies like Apple and Microsoft, Invesco has an expense ratio of 0,20% and an average 18,96% annual return over the past 10 years, a performance impossible to ignore when analizing the best ETFs to invest in 2024.

- iShares Russell 2000 ETF (IWM). This fund tracks the Russell 2000 index, which includes the best 2.000 small capitalization companies in the US, which carry important potential returns. With an expense ratio of 0.19%, this ETF is managed by Blackrock, which is the company that manages more money in the whole world. The actual 10-year return is at 8,23%.

- Vanguard FTSE Emerging Markets ETF (VWO). Since we mentioned ETFs that contemplate companies headquartered in US, despite being the best performing country for decades, as a way to diversify exposure, an emerging markets ETF is a good choice to equilibrate holdings. The fund carries a 0,08% expense ratio a 2,17% annual dividend yield, and invests mainly in China, India and Taiwan. It invests in large capitalization companies like Taiwan Semiconductors, Alibaba and Tencent (China). The fund has a 29-year average annual return of 5,70% as of 2023.

- iShares Core U.S. Aggregate Bond ETF (AGG). With a 0,03% expense ratio and an average annual return of 2,99% since inception (2003), this fixed income ETF is ideal for long-term investors, tracking a benchmark (index) of overall U.S. fixed income performance. Bonds, representing fixed income, are a must when we need to barbell our investment portfolio, due to the low correlation they have against stocks. Fixed income is the safest kind of investment, representing debt, normally issued by governments or big corporations with fixed interest payments. This is why it’s important to include bond ETFs in every portfolio, increasing its exposure as you age.

Careful. The ranking shows best to worst ETFs to hold according to the article author’s opinion, besides, holding all of them or, at least the best ranked ones, is a good way to diversify. Every ETF described above has its own perks and benefits.

Risks of S&P 500

So, as any other asset in the world, an ETF tracking S&P 500 also carries certain risks:

- The US falls as the world economic leader

- A fall in the value of USD

- Loss of competitiveness of US companies

Risks exist in any sector that an ETF could be tracking, but even within this frame, there are certain alternatives.

World tracking ETFs

There are certain ETFs that track assets from the hole world. An example of this is the VT, Vanguard Total World Stock ETF. With an expense ratio of only 0.07% (data from 2023), this fund created in 2008 is composed of almost 10.000 stocks and currently has the following composition regarding to the company’s regions:

| Regions | Weighted Exposure |

| North America | 63,30% |

| Europe | 15,90% |

| Pacific | 10,70% |

| Emerging Markets | 9,80% |

| Middle East | 0,20% |

| Other | 0,10% |

Which are the best performing ETFs?

Despite the fact that past returns never assure future performance of an asset, some ETFs that track certain sector indexes have experienced incredible returns. The boom in technology of the last decades, as well as the narrative ‘’software is eating the world’’, probably have something to do with to of the best performing sectors:

- Nasdaq. With an annualized return of 18.27% over the last 10 years, one of the best ETFs that tracks the Nasdaq 100 is the Vanguard Technology Fund (VGT). The Nasdaq 100 is an index that reflects the performance of the 100 most important technology companies in the United States. Another well-known ETF with excellent performance, and highly chosen by investors, is the Invesco QQQ.

- Semiconductors. The iShares Semiconductor ETF (SOXX) owned by Blackrock has had an annual return of 23.3% over the last 10 years. Used in the vast majority of electronic products, semiconductors have become an essential product in the technological revolution of the 21st century. Other ETFs with similar characteristics include the VanEck Semiconductor ETF (SMH) or the SPDR S&P Semiconductor ETF (XSD). If you want to know which are the best ETFs to invest in 2024, you can’t ignore semiconductors.

Here we show a table of the best performing ETFs in the last 5 years:

You’ve been great to me. Thank you!

Thank you for your post. I really enjoyed reading it, especially because it addressed my issue. It helped me a lot and I hope it will also help others.

Thank you for your articles. They are very helpful to me. May I ask you a question?

Thanks for your help and for writing this post. It’s been great.